We thought it would be timely to give you some key insights into what’s going on in the Brisbane property market because things are looking good for property owners and investors.

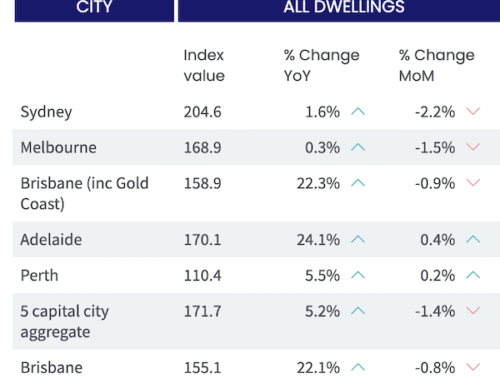

- Brisbane homes have seen extraordinary capital growth, rising 50.2% since March 2020. The strong population growth has been aided by an increase in remote work, increasing housing demand, driving down supply and making it a seller’s market.

- At the end of 2023, Brisbane reached a new milestone with the third-highest median dwelling value among the capitals, behind Sydney and Canberra. In December, the Greater Brisbane median dwelling value was $787,000, surpassing Melbourne’s median value for the first time since July 2009.

- Brisbane’s vacancy rate is 0.9% for houses and 1.0% for units. House rent rose 9.3% over the last 12 months, with units rising an incredible 24.8%. This signifies a rental market in crisis which makes life very difficult for renters.

- A slowdown in construction has contributed to the low supply and shows no real signs of changing in the short term.

- Lifestyle locations in Queensland are proving to continually perform stronger than other areas and the best indicators of lifestyle are:

- Proximity to good schools, parks, shops, hospitals, restaurants.

- Access to employment

- Connection to public transport and/or roads

- Interstate migration is still a big factor due to affordability and lifestyle.

- Queensland’s population is forecast to boom from the current 5.4 million people to 8.27 million by 2046.

- The big 4 banks are predicting a 6-10% property price rise in 2024.

If you already own a property, these stats will be very welcome. If you’re still trying to get your foot on the property ladder, this tells me that you need to get your skates on – but be mindful of where you buy and focus on those lifestyle locations as much as your budget will allow.

Whatever your position is, we’re here to help!