The current property boom is a hot topic right now with lots of people wanting to know how they can capitalise on it. Here are my tips to give you some ideas:

First home buyers

- Get on the bandwagon. Property isn’t going to get any cheaper and it’s going up at a rate faster than most people can save. So if you can afford to buy an investment property in an area that’s cheaper than where you want to live, my recommendation is to do it! Do your research and get your foot on the property ladder. Get in touch if you want to discuss finance options or to see if you’re eligible for any government incentives.

- Get creative with your deposit. Can you team up with a friend or relative to pool your cash and buy together? Or can you ask someone close to lend you some money for your deposit? Can you take on extra work? Can you do anything that will speed up your savings rate or bring forward the date when you’re in a position to purchase? (Note: we always recommend seeking legal advice when entering into financial arrangements)

Home owners

- Join in the frenzy. If you’re thinking of moving – either to upsize or downsize or for a seachange or treechange – do it. You’ll rarely lose out if you’re buying and selling in the same market.

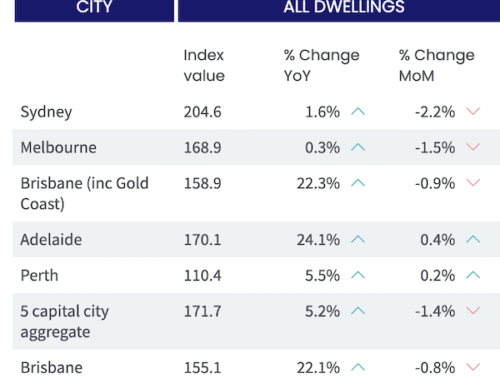

- Refinance, release equity and buy an investment property. The demand for quality rental properties in many areas in south east Queensland is sky high at the moment, with forecast for it to continue. If you have some equity in your home, either through its value increasing or from paying down your mortgage, we can help you refinance so that you can use the equity as the deposit on an investment property. Get in touch if you would like to discuss your options and we can talk loans, and put you in touch with investment property experts and financial planners to make sure you have expert advice.

- Sit back and watch. Do nothing other than know your home is increasing in value! How good is that!!

Investors

- Add to your property portfolio. Email us to arrange a time to discuss your borrowing capacity to see if you have the ability to buy another investment property.

Whatever you decide to do, we’re here to help with all your financial needs, because we love nothing more than helping people buy that house!