We’re here to help with mortgage reviews or pre-approval

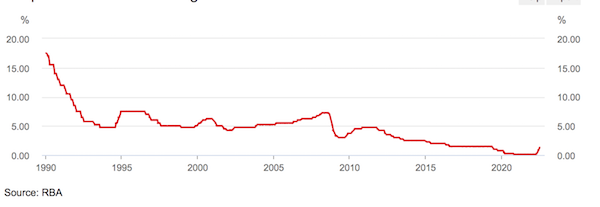

Real estate agents are reporting that they've seen a big increase in the number of properties listed in the last three months. Surprisingly, many of them, particularly in Brisbane and Hobart, have only been in the hands of the current owners for less than three years. Many are being sold by first home buyers and investors. Sadly this is one of the impacts of [...]